Renters Insurance in and around Chicago

Get renters insurance in Chicago

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your possessions are valuable and so is their safety. Doing what you can to keep it safe just makes sense! Your next right step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your couch to your books. Not sure how much insurance you need? We have answers! Alexis Zimmer wants to help you consider your liabilities and help secure your belongings today.

Get renters insurance in Chicago

Coverage for what's yours, in your rented home

Renters Insurance You Can Count On

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Alexis Zimmer can help you create a policy for when the unexpected, like a fire or an accident, affects your personal belongings.

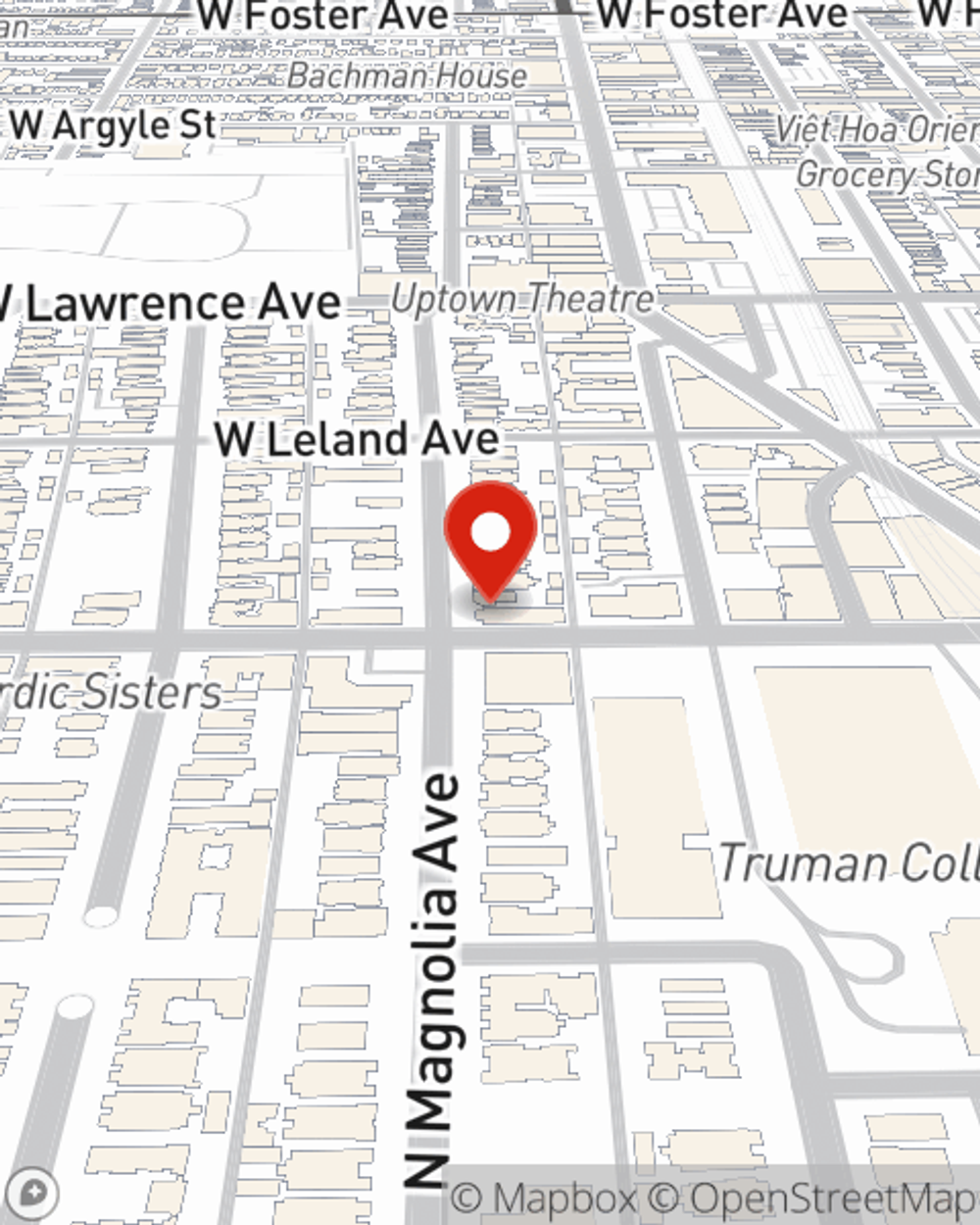

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Chicago. Call or email agent Alexis Zimmer's office for more information on a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Alexis at (773) 442-1270 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Alexis Zimmer

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.